#1 Question Entrepreneurs Have When Fundraising for a Startup

Are you struggling to close your round? Have investors you’ve met ghosted you?

In this article, I want to talk about the #1 question I hear from entrepreneurs looking to start or close their round of financing in the early stage. Before I do, let me briefly introduce my background.

I oversaw deal flow at the largest angel investment group in the world and facilitated over $90 million into well over 80 companies over several years. I worked very closely with a range of investors and learned to talk and think like them. During my 2nd year on the job, I discovered a secret.

The number #1 factor early stage investors look for is proof that your business will work.

That’s right. That business idea or newly minted patent will need proof it will work. Now you might be thinking… Josh, that is ridiculous. Why would I need proof for my idea? I am raising money so that I can build my idea into a product or simply scale up the company.

Let me stop you right there (if you are raising money from VC’s, then this article does not fully apply).

The only folks who will invest in your company with a simple idea may be your friends and family. Those who believe in you firstly, then your business secondarily. Investors on the other hand are numbers oriented and typically always count the risk/reward.

Most people have a huge misconception when looking to raise funding for a business. They think all it takes is a novel idea and a business plan. This is far from the truth.

I found two ways to provide “proof” your business will work. The 1st is building a track record of success building businesses (e.g. you are a serial entrepreneur). The 2nd way is having current sales traction and growth. Let’s dive into these two areas:

1st path – experienced CEO or entrepreneur

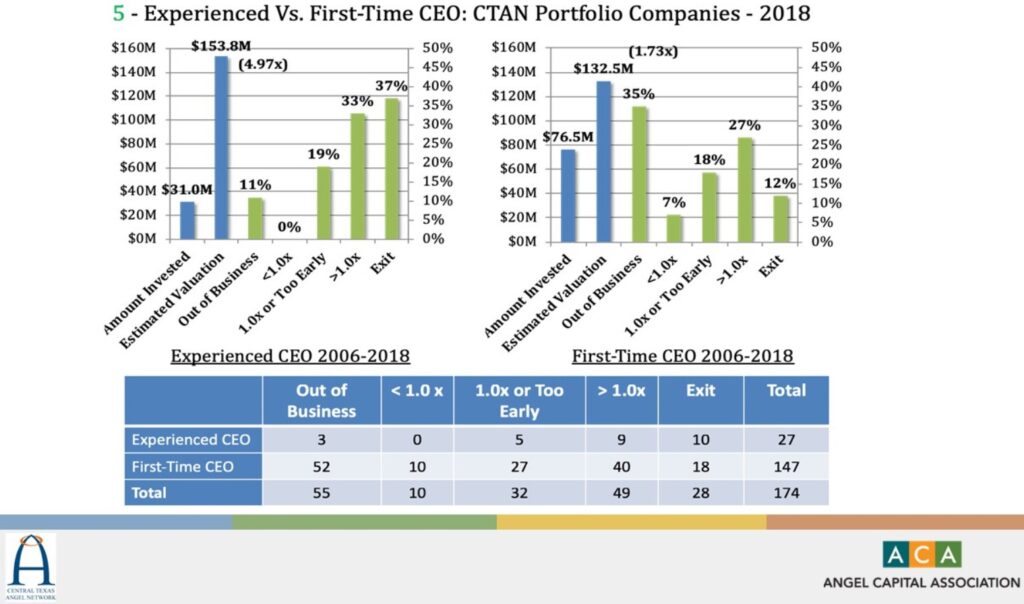

40% of companies that raised funding had CEO’s with former experience as startup CEO’s.

-2019 Funders Report, Angel Capital Association

The data shows experienced CEO’s rose an additional 18% over first-timers. Now you might be thinking… Okay, 6 out of 10 companies were first-timers which isn’t too bad. True. But remember you’re competing for the 60% of the pie, since the 40% is already taken by experienced folks. The point I’m trying to make is that these experienced CEO’s have “proof” based on their previous track record (their resume). This track record gives investors assurance they are bidding on a horse that has won before.

A study done over 10 years by the Central Texas Angel Network (CTAN) found experienced CEO’s yielded higher ROI (see graph below) by a large margin. The data shows investors prefer to invest in companies with proof of leadership and a track record of accomplishments.

2nd Path – Show me the money

An investor will want you to “show me the money,” aka show them your company’s sales traction. Ideally for an investor, a startup investment will have both leadership traction and sales traction. However in the case you don’t have the leadership traction, you can substitute your experience with excellent sales traction. You will need to be generating a substantial amount of revenue in a short amount of time for investors to overlook your resume. The argument here would sound something like this, “I started a company building widgets. I had $500k in sales last year. Been growing xx% month over month (your revenue should like a hockey stick)”.

If you’ve ever watched the TV show Shark Tank, the sharks tend to perk up when the entrepreneur moves to talk sales numbers. This is because the company becomes somewhat “derisked” due to the idea showing proof that it works. In an investors mind, in order to get that sort of sales traction, the company has pivoted, re-iterated, went through product-market fit exercises, and establish their sales processes. The investor at this point is getting a great bang for their bucks since nearly all the heavy lifting in building a company has been done. At this point, the investor could simply provide capital and watch the wheels turn.

Conclusion

It’s not just the pitch, the branding, the network, or the market size that matters. When raising money from angels, you need proof your company will work through past entrepreneurial successes or current sales traction.

The bottom line- you need either your resume or your sales to show a pathway of success in order to successfully raise your round with angels.